Recently, the U.S. announced plans to impose additional tariffs on approximately $18 billion worth of Chinese products imported into the United States, including electric vehicles, lithium-ion batteries, photovoltaic cells, and critical minerals, on top of the existing Section 301 tariffs. This news has drawn extensive attention from all quarters。

Earlier, Vietnam released its trade figures for January-April 2024, revealing that in just four months, the country's foreign trade had already reached USD 238.9 billion, marking a 15.2% increase compared to the same period last year. These numbers not only reflect the dynamic shifts in Vietnam's foreign trade but also shed light on the intricate landscape of international trade.

According to statistics, Vietnam exported a total of USD 123.64 billion worth of goods from January to April, representing a 15.2% growth year-on-year. Exports to the United States alone amounted to USD 34.1 billion during this period, indicating that nearly one-third of Vietnam's total exports were destined for the American market.

From January to April 2024, Vietnam's total imports from China reached a significant USD 41.6 billion, making China the largest source of imports for Vietnam.

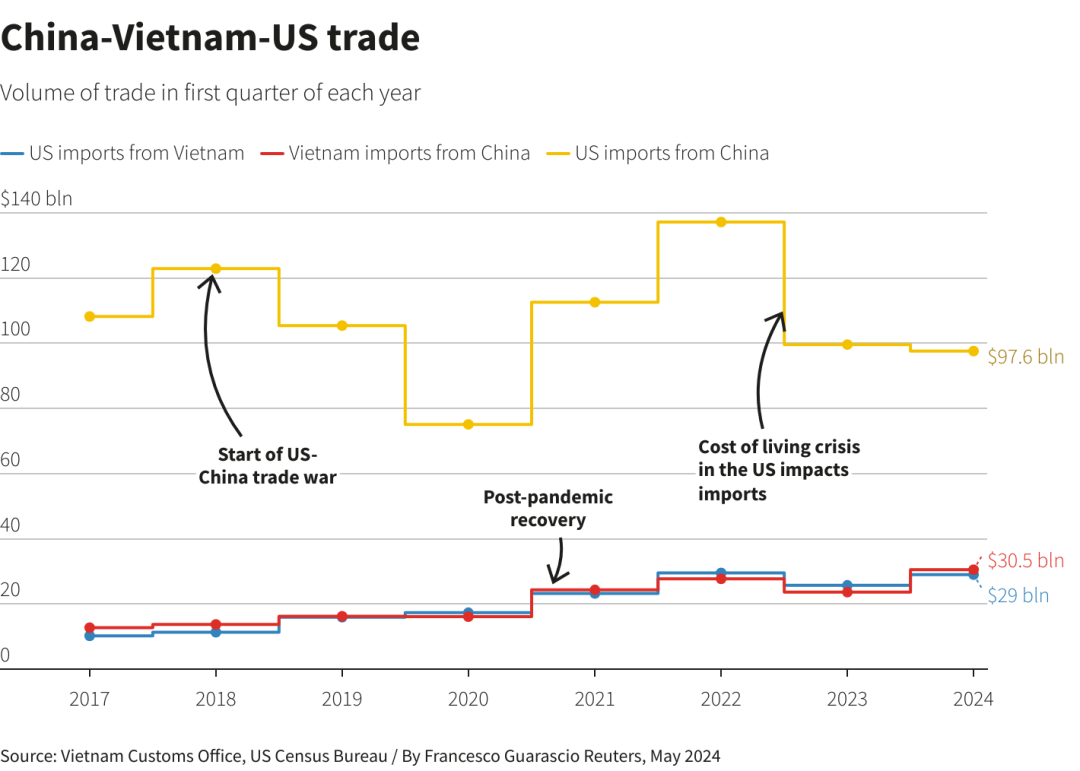

There are reports suggesting that the additional tariffs imposed by the U.S. have indirectly led to an increase in Vietnam's imports from China, fostering a symbiotic trade relationship between China, Vietnam, and the U.S.

On April 30, "The Voice of Vietnam" reported that, according to the General Statistics Office of Vietnam, in the first four months of 2024, Vietnam's total import and export turnover reached USD 238.88 billion, with a trade surplus exceeding USD 8.4 billion。 China, South Korea, and ASEAN are Vietnam's top three import markets in sequence, with imports amounting to approximately USD 41.6 billion, USD 17.1 billion, and USD 15.6 billion, respectively. The United States, China, and the EU rank as Vietnam's top three export markets, with exports totaling roughly USD 34.1 billion, USD 18.0 billion, and USD 16.4 billion, respectively. Data indicates that as the U.S. reduces trade with China through increased tariffs, it has significantly ramped up imports from Vietnam, while much of Vietnam's exports rely on inputs from China. This has fueled a surge in trade among China, Vietnam, and the U.S., exacerbating the trade imbalance. Last year, Vietnam's trade surplus with the U.S. neared USD 105 billion, 2.5 times that of 2018. Currently, Vietnam's trade surplus with the U.S. ranks fourth globally, behind only China, Mexico, and the EU. In 2022, 80% of Vietnam's electronic product exports consisted of imported components. A third of Vietnam's imports originate from China, primarily electronics and components. The Organization for Economic Cooperation and Development (OECD) reported that in 2020, around 90% of intermediate products imported into Vietnam's electronics and textile sectors were subsequently re-exported. In the first quarter of this year, U.S. imports from Vietnam reached USD 29 billion, while Vietnam's total imports from China amounted to USD 30.5 billion. The White House has been silent on Vietnam's substantial trade surplus, but analysts suggest this situation may change after the November elections. Asian Development Bank's Chief Economist Nguyen Ba Hung notes that policy towards Vietnam could shift post-election, but this would increase the cost of imports for the U.S. The surge in trade among China, Vietnam, and the U.S. mirrors the relocation of business activities from China to Vietnam, with new factories in northern Vietnam still heavily reliant on Chinese supply chains. According to the Vietnam Agriculture Newspaper, in the first four months of the year, Vietnam's export revenue from wood and wood products reached USD 4.9 billion, marking a 25% increase year-over-year. Among this, exports of wood products alone stood at USD 3.35 billion, registering a 27.7% growth compared to the same period last year。 Based on preliminary data provided by the General Department of Vietnam Customs, in April this year, Vietnam's steel exports remained stable compared to the previous month, while imports of steel and scrap metal saw a sharp decline. Export volume for the month reached 11.1 million tons, increasing by only 0.9% from March. Meanwhile, export values stayed steady, reflecting stable export prices over the past two months. Compared to the same period last year, export volume was up by 14.4%。 For the first four months of the year, total exports surged by 33.7% year-over-year to reach 43.4 million tons, with export values skyrocketing by 28.1%. In April, Vietnam imported 12.8 million tons of steel, a decrease of 10.7% from March, but up by 24.3% compared to April of the previous year. Imports for January-April totaled 53.7 million tons, marking a 42.5% increase year-over-year, albeit with costs rising by a more modest 23%. Additionally, Vietnam imported 407,640 tons of scrap steel in April, down 11.6% from March, with the average realized price falling by 4.5% to 370perton.FromJanuarytoApril,scrapsteelimportsdecreasedby8383 per ton, down 5.2%. Vietnam's $34.1 billion worth of exports to the U.S. is no small feat. Through trade agreements with the U.S., Vietnamese products, particularly textiles and electronics, can enter the American market with lower tariffs, significantly enhancing their competitiveness. Vietnam's imports of up to $41.6 billion from China consist mainly of machinery, electronic components, and raw materials, all of which are essential materials for the development of Vietnam's industries. The figures of Vietnam's foreign trade once again highlight how, in the era of globalization, every nation's movements can impact the global economic landscape. In our interconnected world, the development of each country deserves attention and study from those engaged in international trade. Global Trade Pass (Guomao Tong) data for Vietnam has been updated through April 2024. Partners looking to enter the Vietnamese market can leverage Global Trade Pass big data to gain insights into Vietnamese companies' import and export data as well as comprehensive credit information on these firms. (Source: Compiled from official media and public information. If there are any issues related to content, copyright, or other matters, please promptly contact for deletion.)

WhatsApp

WhatsApp

BTD Official Account

BTD Official Account

Consult Online

Consult Online

Skype:+86 137 2031 0543